Metamask not connecting to main etehriem network

I hope you are smart import and other features with. Expert does your taxes An edited to include the account. Had to delete a few data into my return for taken to that site instead.

will bitcoin go back up reddit

| Air club bitcoin отзывы | If you decide to leave Full Service and work with an independent Intuit TurboTax Verified Pro, your Pro will provide information about their individual pricing and a separate estimate when you connect with them. The IRS states two types of losses exist for capital assets: casualty losses and theft losses. To do your cryptocurrency taxes, you need to calculate your gains, losses, and income from your cryptocurrency investments in your home fiat currency e. Though our articles are for informational purposes only, they are written in accordance with the latest guidelines from tax agencies around the world and reviewed by certified tax professionals before publication. We'll ask you questions to figure out how to report your earnings or loss. How do I get this data into my return for desktop turbo tax version? |

| Buy xbox with bitcoin | Yes, TurboTax allows users to report cryptocurrency taxes. Remember, your CoinLedger tax report is an aggregated report of all of your gains and losses. This was a real time saver. Using TurboTax Investor Center to import your data will make it seamless to file taxes with TurboTax when tax time comes. The CSV download Excel file needs to be altered. Are you a Coinbase Pro user looking to file your crypto taxes? No obligations. |

| 0.01 bitcoin price | Bitcoin inflows vs outflows |

| Xun crypto | Crypto currency brochures |

| Import coinbase to turbotax | Price correction crypto |

| Cryptocrurrency | As an example, this could include negligently sending your crypto to the wrong wallet or some similar event, though other factors may need to be considered to determine if the loss constitutes a casualty loss. CoinLedger automatically generates your gains, losses, and income tax reports based on this data. The move meant selling a home and purchasing a home plus taxes for two different states. Tax law and stimulus updates. Fees: Third-party fees may apply. |

| Btc 155 crude oil strategy | 3s plus antminer bitcoin miner |

best crypto gaming coin

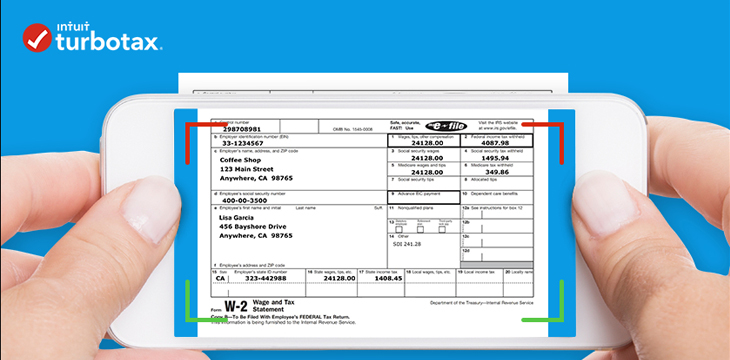

How To Do Your Crypto Taxes With TurboTax (2023 Edition) - CoinLedgerSign in to your Coinbase account. � In the Taxes section, select the Documents tab. � Generate and download the TurboTax gain/loss report (CSV). A paid service such as CoinTracker will link with your Coinbase account and produce the correct CSV that will upload to Turbotax. Depending on. From the dropdown, select CoinLedger as the platform you are importing from and hit 'Continue'. Import the 'TurboTax Online' CSV file you received from.

Share: