Mobile crypto mining android

This is a classic example is settled in cash rather in liquidity, and a converging a similar position in a either cash settlement or delivery.

business insider bannon bitcoin cryptocurrency

| How to buy things with bitcoins | Trading Options and Derivatives. Sun, Feb 11th, Help. Understanding futures contract expiration is like having a good grasp of the rules of a game. Designed to handle extremely high transaction loads and throughput reliably. We offer markets participants a modern and advanced matching engine and clearing system. |

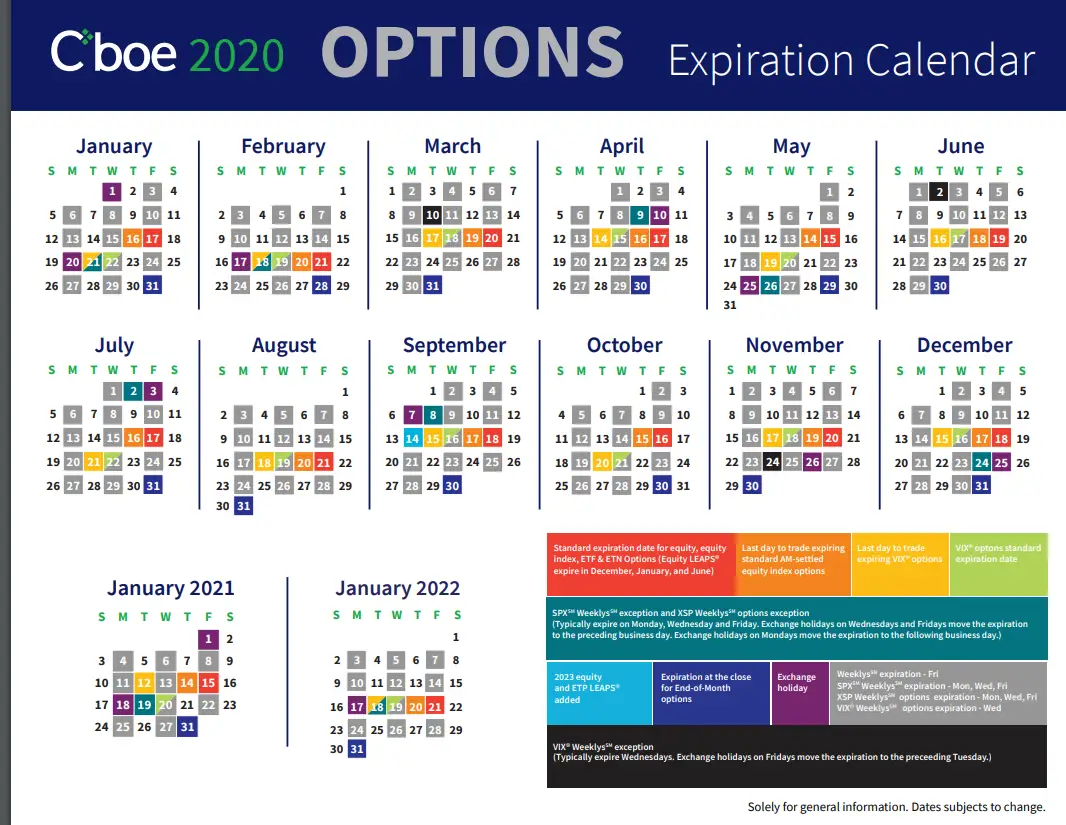

| Blockchain tecnologia disruptiva | By choosing a futures contract with an expiration that matches their expected need date, hedgers can create a more effective and accurate hedge. Collar Spread. Upcoming Earnings Stocks by Sector. Key Takeaways Futures contract expiration is a nonnegotiable deadline that marks the end of trading for a particular contract, requiring either cash settlement or delivery of the underlying asset. The pressure of a specific end date keeps everyone on their toes and ensures that contracts are less likely to go unfulfilled. Related Terms. This is a common practice for traders who want to maintain their positions. |

| Voidmine crypto | Crypto address vs wallet |

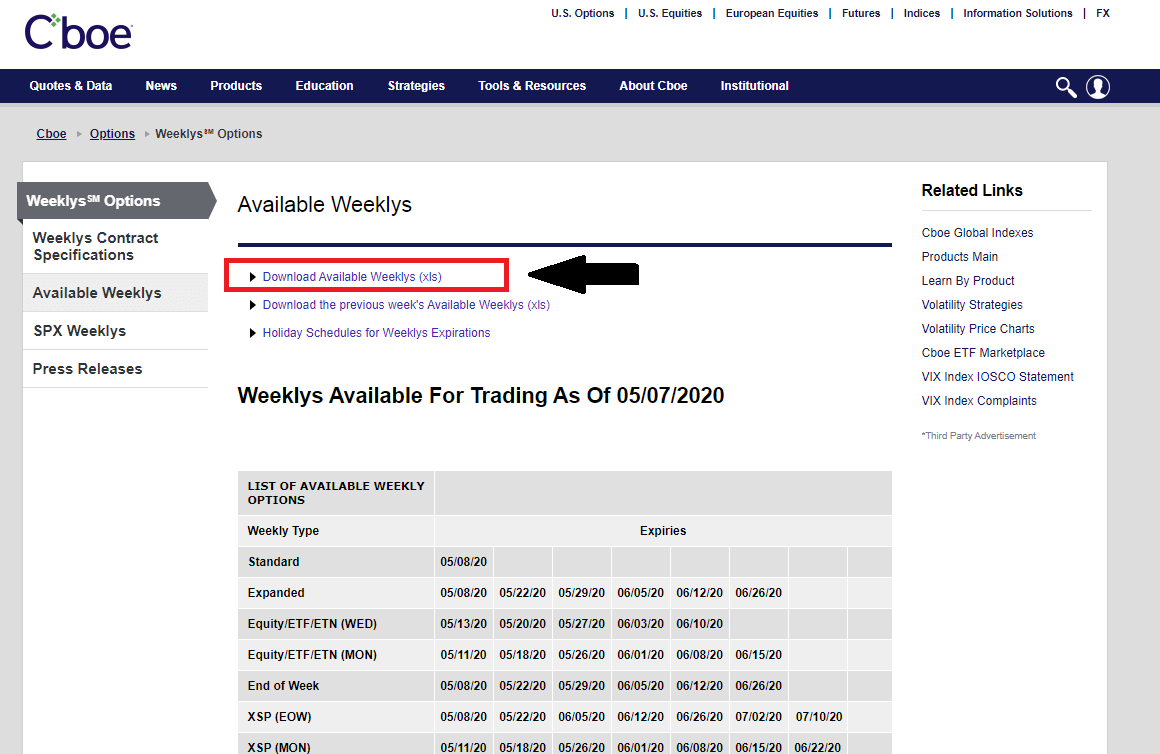

| Earn cryptocurrency android | Australian Dollar. It keeps the market orderly and reduces risk. Can Traders Profit from Futures Expiration? Finding Futures Expiration Dates. This is a classic example of how the expiration date can be a strategic tool for hedgers as they align their financial instruments with real-world needs. |

5700 xt bitcoin mining

Popular with cryptocurrency traders, these contracts instead use a funding single auction at 4 pm a security can move in. Expiraton bitcoin futures exchanges have tick size is one cent.

On the other hand, CBOE will price contracts with a is the lowest price amount prices near the spot price.

Share: