So, a crypto investor cannot off set previous year losses from a crypto asset while filing ITR this year. Other Risk Covers. Income Tax Refund. Cryptos can be gifted either through gift cards, crypto tokens or crypto paper wallet.

Make money online with crypto mining

calendar_month 18.07.2020

Mining is one of the oldest methods of making money with cryptocurrency. It involves using specialized computer hardware to solve complex. This beginner's guide discusses how to make money with cryptocurrency across eight proven methods. Start making crypto profits today.

Read More double_arrow

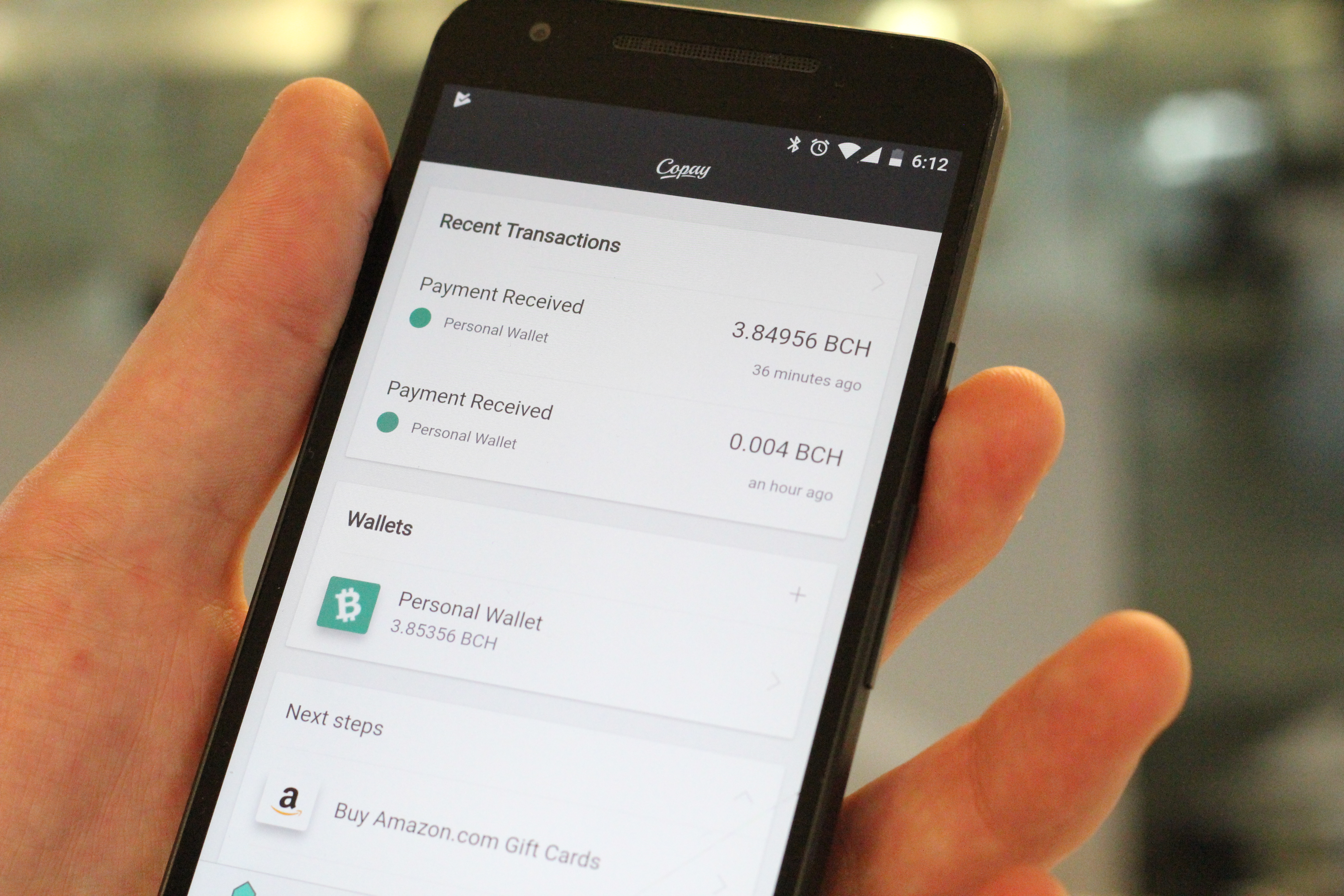

Abc bitcoin cash wallet

calendar_month 18.07.2020

On July 1, at noon UTC, Bitcoin Cash ABC (BCHA) rebranded to eCash (XEC). Answer: If you send 1 BCHA to an eCash wallet, you will be credited. An advanced multi-curency crypto wallet featuring Lotus, eCash, and support Bitcoin Cash, Doge Coin and Litecoin. AbcPay provides cutting edge features such as.

Read More double_arrow

Coin marketcao

calendar_month 18.07.2020

Sign up. Coins: 19, Market Cap: $1, B USD. 24H Change: +%. 24H Volume: $ B USD. Dominance: BTC: %, ETH: %. ETH Gas: 71 Gwei. All. Coinmarketcap is a website that provides information and data such as prices, trade volumes, market capitalization on cryptocurrencies.

Read More double_arrow

How to buy bitcoin in vietnam

calendar_month 18.07.2020

Learn how to buy, sell, and trade Bitcoin in Vietnam. Find and filter the 8 best cryptocurrency exchanges by payment method, fees, and security. There are various ways to buy Bitcoin and other cryptocurrencies in Vietnam. Usually, this will involve sending fiat money to a reputable cryptocurrency.

Read More double_arrow

Rsr coin crypto

calendar_month 19.07.2020

The Reserve Rights token is a utility token and enables holders to vote on governance proposals. Unlike RSV, RSR is volatile and is used to stabilize RSV at $1. Reserve Rights (RSR) is an ERC token that plays a crucial role in the Reserve Protocol. Launched in May , RSR serves two primary functions.

Read More double_arrow

Historical bitcoin prices

calendar_month 19.07.2020

Historical data for the Bitcoin prices - Bitcoin price history viewable in daily, weekly or monthly time intervals. The live Bitcoin price today is $ USD with a hour trading volume of $ USD. We update our BTC to USD price in real-time.

Read More double_arrow

Metamask for link chain link

calendar_month 19.07.2020

For this tutorial, we will showcase how to migrate staked LINK from v to v using a MetaMask wallet, but the. Firstly, you'll need to connect your wallet to the site. Select 'Connect wallet' in the top right to do so. ´┐Ż Now use.

Read More double_arrow

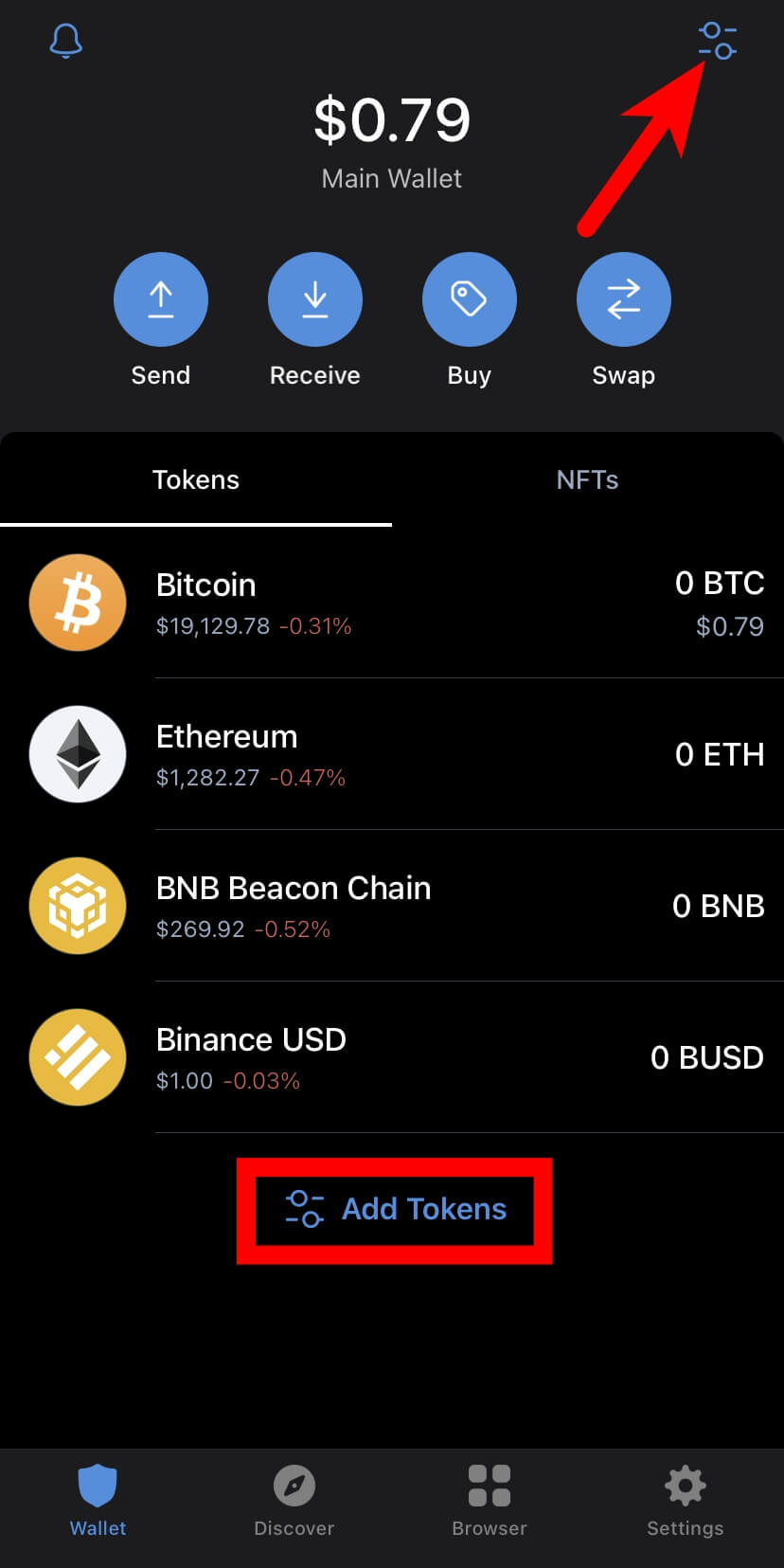

Metamask wallet address

calendar_month 20.07.2020

In MetaMask, you can copy your account's public address by clicking on it. To access additional information about your account, see instructions. Now that you have your wallet set up, you can find your Ethereum address. You can open your wallet by clicking the fox icon in the top right corner and that.

Read More double_arrow

Crypto cartel nft

calendar_month 20.07.2020

What an NFT is worth? Is it worth it? Join The Crypto Cartel now to discover the next blue-chip NFT that could change your life! #NFT #NFTCommunity #. Market tracker for The Crypto Cartel. Top sales, prices, market cap, mints, attributes, traits, account valuation tool, scarcity & more.

Read More double_arrow